Introduction: A receipt is a written acknowledgment that a person has received money or property in payment following a sale or other transfer of goods or provision of a service. The recipient of the payment is a legal requirement to collect sales tax or VAT from the customer.

In many countries, a retailer is required to include the sales tax or VAT in the displayed price of goods sold, from which the tax amount would be calculated at the time of sale and remitted to the tax authorities in due course. Similarly, amounts may be deducted from amounts payable, as in the case of wage withholding taxes. On the other hand, tips or other gratuities are given by a customer, for example, in a restaurant, would not form part of the payment amount or appear on the receipt.

In some countries, it is obligatory for a business to provide a receipt to a customer confirming the details of a transaction. In most cases, the recipient of money provides the receipt, but in some cases, the receipt is generated by the customer, as in the case of goods being returned for a refund. A receipt is not the same as an invoice.

There is usually no set form for a receipt, such as a requirement that it be machine generated. Many point-of-sale terminals or cash registers can automatically produce receipts. Receipts may also be generated by accounting systems, be manually produced or generated electronically.

Receipts are also useful for returning or exchanging purchased goods, and also reduce fraud by providing proof of purchase with accurate details such as date, location, salesperson, and cost. They create accountability for salespeople (who are responsible for the details of a transaction), as well as for customers (who must keep track of their receipts for future reference). If you work for a business that reimburses costs related to travel, client meetings, or other business needs, you may need to submit receipts in order to receive timely reimbursement. In some settings, a receipt may be written by hand, but a template can provide a high-quality option that saves time and money, is fully customizable, and is easy to print and use.

Types of Receipt Templates

-

Depository Receipt

A depository receipt (DR) is a negotiable financial instrument issued by a bank to represent a foreign company’s publicly traded securities. The depository receipt trades on a local stock exchange. Depository receipts facilitate buying shares in foreign companies because the shares do not have to leave the home country.

Depositary receipts that are listed and traded in the United States are American depositary receipts (ADRs). European banks issue European depository receipts (EDRs), and other banks issue global depository receipts (GDRs).

- BREAKING DOWN ‘Depository Receipt’: When a foreign-listed company wants to create a depository receipt abroad, it typically hires a financial advisory to help it navigate regulations, a domestic bank to act as custodian and a broker in the target country to list shares of the firm on an exchange, such as the New York Stock Exchange (NYSE), in the country where the firm is located.

- How it Works: A depository receipt typically requires a company to meet a stock exchange’s specific rules before listing its stock for sale. For example, a company must transfer shares to a brokerage house in its home country. Upon receipt, the brokerage uses a custodian connected to the international stock exchange for selling the depository receipts. This connection ensures that the shares of stock actually exist and no manipulation occurs between the foreign company and the international brokerage house.

- A typical ADR goes through the following steps before it is issued:

- The issuing bank in the U.S. studies the financials of the foreign company in detail to assess the strength of its stock.

- The bank buys shares of the foreign company.

- The shares are grouped into packets.

- Each packet is issued as an ADR through an American stock exchange.

- The ADR is priced in dollars, and the dividends are paid out in dollars as well, making it as simple for an American investor to buy the stock of a U.S.-based company.

Types of DR:

- American Depository Receipt

- European Depositary Receipt

- Luxembourg Depositary Receipt

- Global Depositary Receipt

- Indian Depository Receipt

Additionally, CREST Depositary Interests (CDIs) in the United Kingdom function similarly, but not identically to depositary receipts.

Pros and Cons of Depository Receipts

Depositary receipts let U.S. investors purchase shares in foreign companies in a more convenient and less expensive manner than purchasing stocks in foreign markets. Also, U.S. investors may use depositary receipts to diversify their portfolios on a worldwide scale.

However, many depositary receipts are not listed on a stock exchange and are illiquid or traded only by institutional investors. Also, the liquidity of trading unsponsored depositary receipts is low, and the securities are not backed by a company. Investors may lose their entire principal. The depositary receipt may be withdrawn at any time, and the waiting period for the shares being sold and the proceeds distributed to investors may be long. The bank may impose a substantial administration fee for each depositary receipt holder, reducing any potential gain from the receipt.

2. Return Receipt

Return Receipt is proof of delivery provided by the U.S. Postal Service (USPS), in the form of a document or electronic mail. Return receipt also may refer to Microsoft Outlook’s Delivery and Read Receipt functions. In the e-mail, the term return receipt is somewhat misleading. When delivering a message to a recipient’s computer system there is no way to force that computer system to issue an acknowledgment to the sender.

This is in contrast with a physical delivery medium in which a courier acting on behalf of the sender can honor the sender’s requirements for delivery – including hand-delivery of the message to the recipient and even requiring that recipient to authenticate himself to the courier before receiving the message. This difference in capability between physical delivery systems and electronic mail causes confusion and misunderstanding. For this reason, many experts eschew the term return receipt in connection with e-mail, in favor of less misleading terms.

However, two notification services similar to those available for physical delivery are available for e-mail. One is called Delivery Status Notifications or DSNs, and the other is termed Message Disposition Notifications or MDNs.

- Delivery Status Notifications or DSNs: DSN refers to both a service that may optionally be provided by Message Transfer Agents (MTAs) using the Simple Mail Transfer Protocol (SMTP) and a message format to be used to return indications of message delivery to the sender of that message. Specifically, the DSN SMTP service is used to request that indications of successful delivery or delivery failure (in the DSN format) be returned. Issuance of a DSN upon delivery failure is the default behavior, whereas issuance of a DSN upon successful delivery requires a specific request from the sender. Note that for various reasons, it is possible for a message to be delivered, and a DSN being returned to the sender indicating successful delivery, but the message subsequently fails to be seen by the recipient or even made available to them. The DSN SMTP extension, message format, and associated delivery status codes are specified in RFCs 3461 through 3464 and 6522.

- Message Disposition Notifications or MDNs: MDNs provide a notification of the “disposition” of a message – indicating, for example, whether it is read by a recipient, discarded before being read, etc. However, for privacy reasons, and also for backward compatibility, requests for MDNs are entirely advisory in nature – i.e. recipients are free to ignore such requests. The format and usage MDNs are specified in RFC 3798.

A description of how multiple Mail User Agents (MUAs) should handle the generation of MDNs in an Internet Message Access Protocol (IMAP4) environment is provided in RFC 3503.

A non-standard but widely used way to request return receipts is with the “Return-Receipt-To:” (RRT) e-mail header. An e-mail address is specified as the content of the header. The first time a user opens an e-mail message containing this header, the client will typically prompt the user whether or not to send a return receipt.

How Does Return Receipt Work?

Return Receipt is purchased at the time of mailing. Customers are given the option to purchase a physical return receipt or an electronic receipt. Once purchased, the USPS will return either a physical return receipt or an electronic receipt including the recipient’s signature once the mail piece has been delivered.

In the event that you need to prove that a particular mail piece has been delivered, you can use the receipt to help prove when your mail piece reached its destination.

To use Return Receipt, the USPS requires a special form which can be obtained at the Post Office. These forms can be filled out by hand; alternatively, Stamps.com also offers special certified mail labels that can be automatically filled out by software.

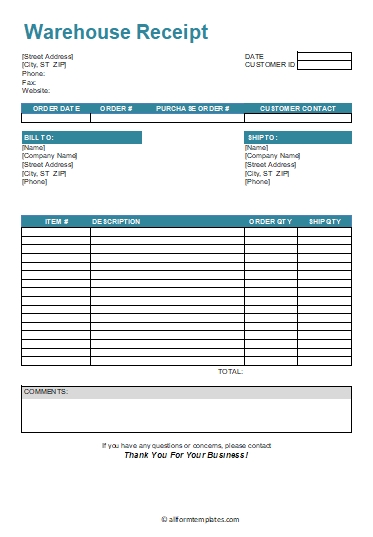

3. Warehouse Receipt

A warehouse receipt is a document that provides proof of ownership of commodities (e.g., bars of copper) that are stored in a warehouse, vault, or depository for safekeeping.

Warehouse receipts may be negotiable or non-negotiable. Negotiable warehouse receipts allow the transfer of ownership of that commodity without having to deliver the physical commodity. See Delivery order.

Most warehouse receipts are issued in the negotiable form, making them eligible as collateral for loans. Non-negotiable receipts must be endorsed upon transfer.

Warehouse receipts also guarantee existence and availability of a commodity of a particular quantity, type, and quality in a named storage facility. It may also show the transfer of ownership for immediate delivery or for delivery at a future date. Rather than delivering the actual commodity, negotiable warehouse receipts are used to settle expiring futures contracts.

Warehouse receipts may also indicate ownership of inventory goods and/or unfinished goods stored in a warehouse by a manufacturer or distributor.

BREAKING DOWN ‘Warehouse Receipt’: Rather than delivering the actual commodity, warehouse receipts are used to settle expiring futures contracts. Also referred to as a vault receipt, they are most often used when settling futures contracts that have precious metals as their underlying commodities.

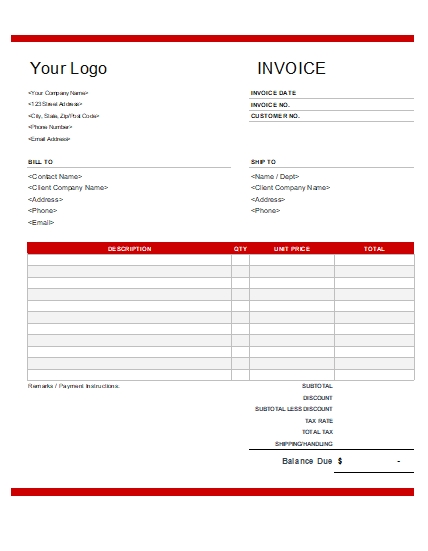

4. Invoice Receipt

An invoice is a document which the seller issues to buyer citing the agreed price to be paid by the latter – and invoice receipt certifies that the buyer has already paid the dues.

An invoice is a bill, or a request for payment, for a sale. It lists goods or services provided by the seller to the customer, along with prices, credits, discounts, taxes, and total due. It may also include credit information, an invoice number, a salesperson’s name, and any special sales programs. For example, many invoices allow the buyer 30 days to pay and offer a discount for paying within the first 10 days of the invoice date. An invoice includes business contact information for the seller, including business name, address, phone number, fax number, and web address. It also includes contact information for the buyer and the date of the sales transaction. Invoices should not be confused with purchase orders, which are written requests from buyers to sellers authorizing the shipment or delivery of goods with the agreement to pay.

Uses: Invoices are used to request payment from buyers, keep track of sales, help control inventory and facilitate the delivery of goods and services. Invoices are also used to track expected future revenues and to manage customer relationships by offering favorable payment options, such as extended time periods for payment or discounts for early payment or cash payment. Receipts are used by buyers or customers to prove they paid for an item, especially in return situations in which goods are faulty or defective.

15+ Examples and Formats Receipt Template

A receipt document consists of information regarding the transactions, whether goods or services are purchased, items are donated, money is deposited to secure a lease, or petty cash is removed from a business fund.

Receipts are basic documents for record keeping that can help customers track their purchases, while businesses or other organizations may use receipts to keep accurate records. This can be especially important during tax season – individuals may need receipts in order to claim deductions, and businesses may need receipts to support an audit.

Receipts are also useful for returning or exchanging purchased goods, and also reduce fraud by providing proof of purchase with accurate details such as date, location, salesperson, and cost.

Below is a variety of blank receipt templates which can be personalized by adding your company logo, changing colors, or editing the information included. It includes a broad selection of receipts ranging from cash transactions, taxi services, itemized business invoices, donations, and deliveries.For enhanced functionality and flexibility, you can also create a receipt template using Smart sheet.

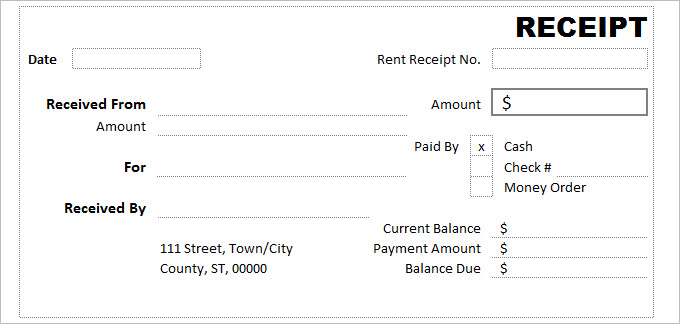

- Rental Receipt Template: As proof of payment (especially if rent is paid in cash), landlords may provide tenants with rent receipts. Templates make this easy by providing reformatted receipts that show the rental period, payment date, type of payment received, and other information. Rental receipts are useful for both landlords and tenants since landlords want to record transactions for future reference, and renters may need documentation in the case of a dispute or misunderstanding about payments.

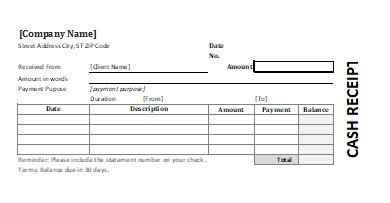

- Cash Receipt Template: Whether you’re selling goods or services, if you accept payments in cash, you’ll want to offer customers a receipt so that they have some proof of purchase. Cash payments are common for many small businesses, restaurants, and events, and individuals may need to provide a receipt when selling a used car or other items. Cash receipts are especially important when it comes to filing taxes. Customize your cash receipt templates to include whatever information best suits your business or personal needs.

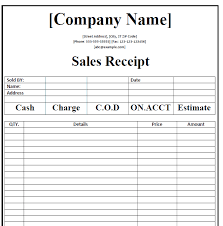

- Sales Receipt Template: Sales receipts provide detailed information on what items were purchased, the payment method used, total costs, and more. Tracking sales can be helpful for business accounting, tracking salesperson and product performance, resolving questions and returns, and providing quality customer service. This sales receipt template includes receipt and customer numbers for tracking, plus automatic calculations that include tax and shipping if needed.

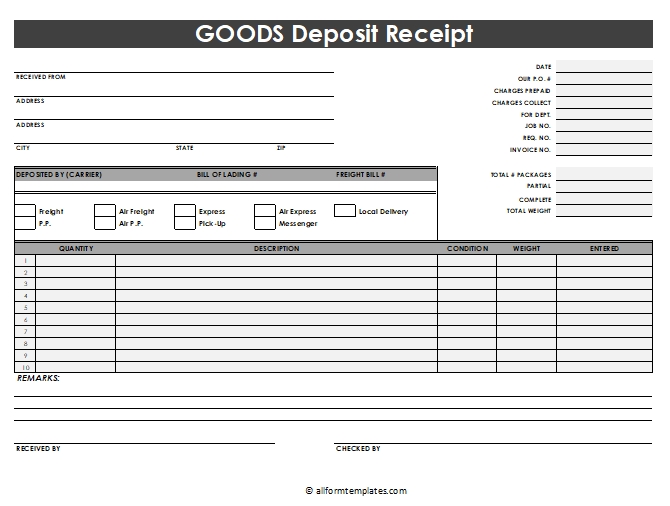

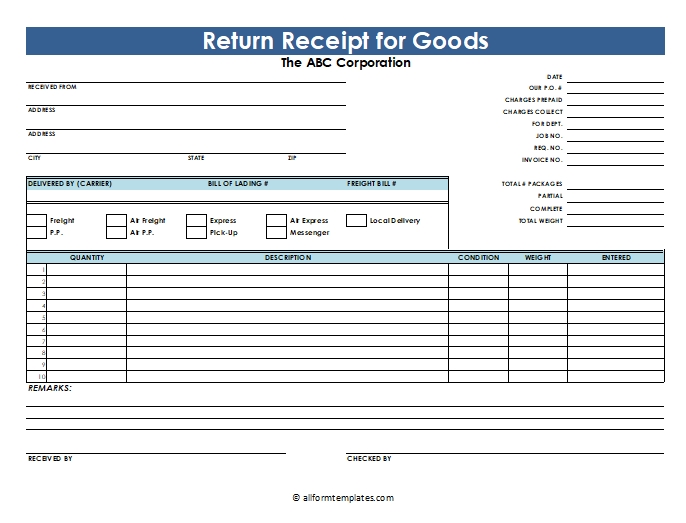

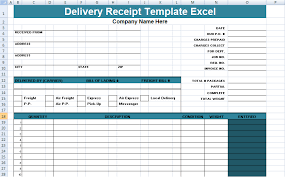

- Delivery Receipt Template: A delivery receipt confirms that a delivery was made and includes information such as the quantity and type of packages delivered. This is helpful for customers to ensure that they are getting correct items, and it provides businesses with documentation of successful delivery. This delivery receipt template includes a signature line for the receiving party as proof that the delivery was accepted.

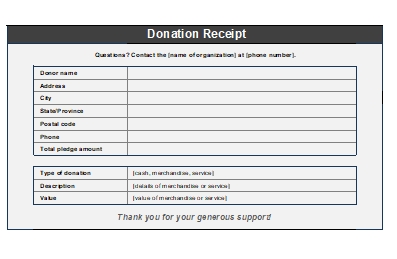

- Donation Receipt Template: Donation receipts come in handy during tax season, when donors need to show what gifts they have made to various organizations. There are laws regarding charitable receipts and tax deductions, so check with the IRS to make sure that your donation receipts include all required information. This donation receipt template has space for detailed descriptions of items donated as well as the monetary value or cash donations. Organizations can add a logo to personalize the receipt, plus the necessary details to appropriately document donor information and the completed transaction.

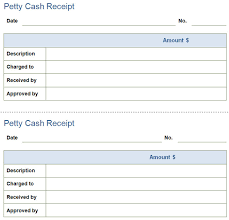

- Petty Cash Receipt: Many businesses keep a petty cash fund on hand to cover small expenses such as coffee, cleaning supplies, postage, or other office supplies. It’s up to each business to decide what types of purchases and what level of cost is appropriate for petty cash. To keep track of how this fund is being used, it’s important to create a receipt for each withdrawal that shows the amount of petty cash and why it was used, who received the cash, and who approved the transaction.

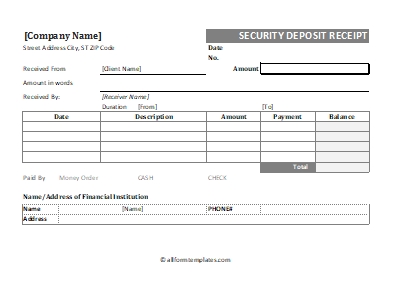

- Security Deposit Receipt: A security deposit is a typical part of a lease agreement contract. When a security deposit is paid, landlords have the reassurance that funds are available if a tenant causes damage to property. The deposit may also help protect tenants if they are unable to pay for damage or even rent at a future date. Security deposits will vary in amount depending on the property and rental cost, but a receipt will provide tenants with proof of payment and may also explain some terms of the lease. This can be an important reference tool for tenants and landlords in case there is any misunderstanding or conflict during the lease.

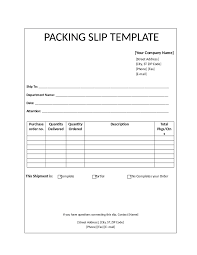

- Packing Slip Template: A packing slip lists purchased items and order quantities and can be included with a payment receipt when mailing items to customers. This helps ensure that the proper items are included in a shipment, identifies discrepancies in the items ordered versus shipped, and helps customers organize their inventory once the shipment is received. This packing slip template includes item numbers and descriptions, salesperson name, packing date, and more.

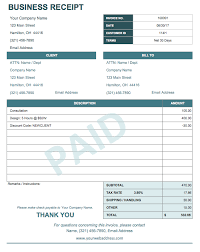

- Business Receipt Template: This business receipt template provides a general format that is appropriate for a variety of transactions. It can be used as an invoice to collect a payment, or as a receipt to verify that payment has been received. You can add your business logo and other information to the template to make it your own.

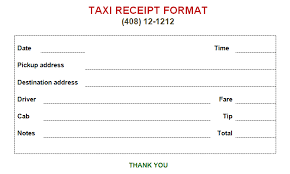

- Taxi Receipt Template: Create a customized taxi receipt template to record all of the important details related to a cab service transaction. This may include driver information such as name, identification number, license, and taxi number, plus travel details like location, distance, and total cost. A tax receipt can be useful to customers who need evidence of their trip to get reimbursed by an employer, or to detail business expenses on a tax return. It can also be useful for taxi drivers to keep accurate mileage and financial records.

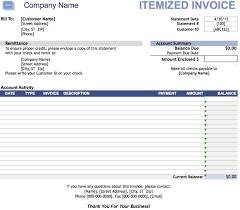

- Itemized Service Invoice Template: An invoice or receipt for services shows an itemized list of completed tasks and their associated costs. If you’re a freelancer or contractor, you may need to provide clients with a service invoice in order to account for your hours and receive payment. This invoice template calculates the subtotal for completed services as well as a grand total including tax and any other fees. If needed, there is room on the template to include additional instructions.

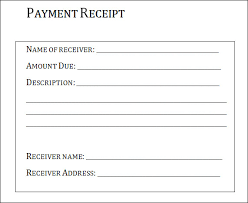

- Payment Receipt Template: This payment receipt template in Word format provides multiple receipts on a single page. Each blank receipt has sections for a description of the item or service purchased, the date of transaction, customer and business information, and itemized payment info, including tax.

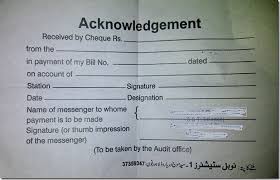

- Acknowledgment Of Payment Receipt: After payment has been made, it is usually followed by a letter acknowledging the payment. If you have been assigned this task, just take a look at this payment received with thanks, template. You can download this template and include any information that you think is important.

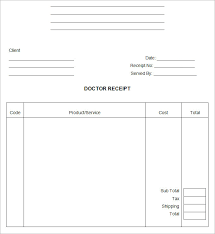

- Blank Doctor Receipt Template: This blank sample makes for quite a pretty cash excel sheet template. Since it is blank, you do not have to adhere to the conventional methods in which a payment receipt is usually designed. You can put your thinking cap on, and be as creative as you want.