Every business is established with some goal or direction in mind, and a business plan helps to provide direction to a new or even an established company. So today we shall be discussing business plans, types xof business plans, and provide you with some sample business plans. A business plan acts a roadmap for the business which helps the Board of Directors, investors, and other key stakeholders in making major decisions. So if you have just begun your business and you need to prepare a business plan for any reason, such as attracting investors or preparing yoru sales or marketing strategy, you might find some difficulty as to what should be the contents of the plan. It is especially important for business expansion purposes and when you need to apply for a loan waiver, raise investor capital or simply want to provide the aims and goals of the company for the next few years.

Here we have explained you the concept of business plans, type of business plans and some templates of business plans.

Introduction to Business Plan templates

Writing a business plan is a prerequisite to your company’s success. A solid plan is necessary to help find your company and ensure that your goals remain on track over time. Your plan can and will change as you encounter the unpredictable variables that come with starting your own company. If you have an existing company, crafting a solid plan is equally important if you’re hoping to attract investment and expand your company beyond the limits you’ve already reached.

Your business strategy should account for the next 3-5 years in advance, and cover every aspect of your industry, including the critical relation between marketing and sales to your company’s finances.

Your business plan should provide all the details about the business concept that you have tried to illustrate, the marketplace and the expected financial performance in your business.

Top Tips

· Be concise: It’s really important that potential investors can understand what your business is all about from a quick glance at your plan. It is so because the investors have expectations from your business, that they would be able to earn back the money they have invested along with profits. So teh primary purpose of writing a business plan must be to briefly explain to your potential investors that your business is growing by presenting them with various details about the company such as cash flow, expenses, industry projections, etc.

· Be specific: Being specific is just as important as being concise. The details will help you drill down into how you will actually deliver your plan. Be specific about what you want to achieve from your business in a concise way as possible.

·Know your market: A big part of knowing whether your business will be successful is understanding your audience. Make sure your plan is clear about your target market – who will you be selling to and how many other companies are already selling similar products? Understanding your target audience must be done at the beginning of establishing of your business. Since this is an important aspect of your business it must be clearly mentioned in your business plan. The wider question which your business plan must cover are what products or services you have to offer and to whom are you making this offer.

·Know your finances: The other essential part of a business plan is the finance section, as finance is the most important part for anything in the world. If your business isn’t going to make any money, it won’t be successful so you need to be very clear on how you will make a profit.

The most essential part fo any business is finance, as, without money, your business won’t reach anywhere and would eventually fall down. Hence while making a business plan you must include the potential sources for making a profit for your business.

Your plan will be incredibly useful when it comes to securing loans and investment, but it’s not only restricted to this but there are many more advantages to it. It’s also a personal tool to help you understand your objectives.

The advantages of a business plan is not only when you need to secure a loan or investment, but also in every aspect of the business. It is a living document which anyone can refer to understand the goals and objectives of a business.

Do a SWOT analysis to determine your strengths, weaknesses, opportunities and threats. Ask your adviser or mentor to review your plan and give you feedback and suggested improvements.

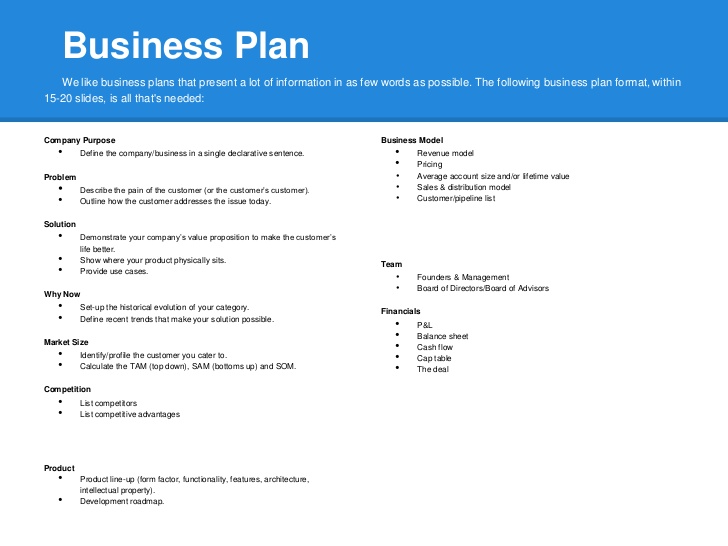

Various Design of Business Plan Templates

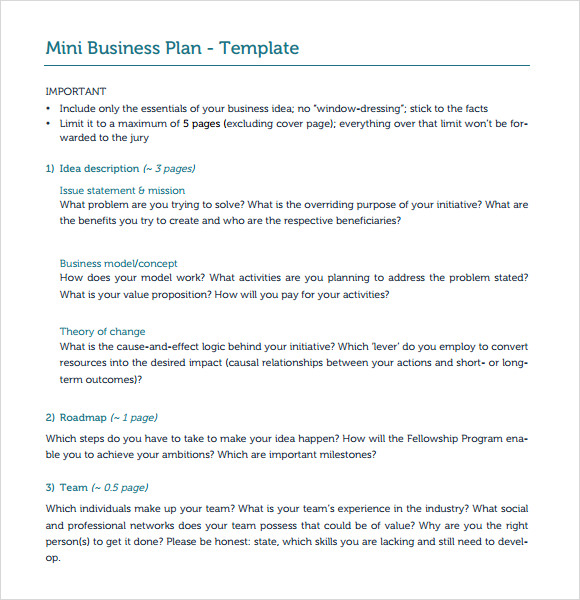

Business plans can be divided roughly into four distinct types. The Mini plan: It is the easiest and quickest reference plan for your business. The mini plan is preferred by many recipients because it is easy to look for and they can download stand read it quickly and even refer to read later on their iPhone or tablet.

· The Presentation Plan: The advent of Microsoft PowerPoint presentations to the tech world has changed the way many things used to work if not all but the way most of the plans were presented. And while the plan is shorter than its predecessors, it’s not necessarily easier to present.

While in a presentation make sure that your plan is concise, don’t be fooled: It takes plenty of planning before you actually set out to present it. The pertinent questions who, what, where, why, when and how all need to be answered before anyone pinpoints and asks you.

·The Working Plan: A working plan is a tool to be used to operate your business. It has to be long in detail but may be short on presentation. As in with a mini-plan, you can probably, afford to have a somewhat higher degree of informality when preparing and planning out a working plan.

For example: If in a plan, you have intended to present this plan to a bank loan committee, then you might have to describe a rival as “competing primarily on a price basis” or if your comment has to be the same competitor you might put it as “When is Jones ever going to stop this insane price-cutting?”

· The What-If Plan: When you face unusual circumstances, you need a variant on the working plan. For example, you might want to prepare a contingency plan when you’re seeking bank financing. A contingency plan is a plan based on the worst-case scenario that you can imagine your business would face in near future such as loss of market share, heavy price competition, the defection of a key member of your management team and soothe the fears of a banker or investor.

Why we need a business plan templates

Should a customized business plan template be used, if not then which approach should be followed?

There are many ways of approaching about how to write a business plan, and every approach has its benefits over other but some are better than others. Though it is difficult still can you find a completed business plan that matches your business, change the names, and that you can call your own? Well, you could, but a business plan template might be a better idea for this instance.

Let’s have a quick glance through the pros and cons of using a business plan template to start your planning process, maybe it proves beneficial for you.

Implementing Your Business Plan

- Your business plan must be adaptable to changes and should be a living document. As the business undergoes many changes throughout the years, so also your business plan must be a living document. It means that you must be able to make changes to the document when required.

- It should always be kept at some place where it can be easily accessible by anyone and must be kept at the top of the mind of your team.

- Reflect your goals in the day-to-day operations of your business. It must reflect the goals for guiding the day-to-day operations of the business.

- Outline the most practical and cost-effective way to achieve each goal – make a note of any extra resources you’ll need. Apart from specifying the goals, it must also outline the most feasible action plan to achieve these goals.

- Make it clear these goals are the top priority for the business. The document must give the impression that the business is growing and achieving these goals is the top priority for the business.

Try this SWOT tool – Strengths, weaknesses, opportunities, and threats

- Conducting a SWOT analysis helps you to analyze the consequences of your plan plans and how can it be made better.

- Strengths and weaknesses are typically inside your business — The strength and weakness of your company can basically be analyzed by assessing your competitor’s strategies and explore the new opportunities which can be profitable for your company. On the other hand, it also gives us insights regarding risky ventures or threats, which must be avoided.

Review your business plan

- Try to reach your key milestones as reflected in your business plan every month and keep track of them on a daily basis.

- Stay on top of industry trends and stay connected with your customers – this will help you stay ahead of any changes needed in your business. Keep a watchful eye on the industry trends and your customer requirements. Study and implement those learnings to make any desired changes in your business.

- There might be situations arising which might affect your business and industry for the short or the long term. Make sure to update it in your business plan and handle it carefully.

Common mistakes

- Not being able to clearly articulate your business and the value it offers to customers. Not being able to present your business goals and values and presenting all aspects of your business goals.

- Not depending upon the reviews or opinions of the customers and making your own assumptions regarding products or services.

- Not reviewing and monitoring your business plan.

- Setting unrealistic or uninformed targets.

Top Ten Do’s and Don’ts

The DO’S

- Prepare a complete business plan jotting every detail you have in your mind for any business you are considering.

- Use the business plan templates for this purpose and do a self-research, before you set on.

- Complete sections of your business plan as you proceed through the course.

- Research (use search engines) to find business plans that are available on the Internet.

- Package your business plan in an attractive kit as a selling tool.

- Submit your business plan to experts in your intended business for their advice.

- Spell out your strategies on how you intend to handle adversities.

- Spell out the strengths and weaknesses of your management team.

- Include a monthly one-year cash flow projection.

- Freely and frequently modify your business plans to account for changing conditions.

The DON’TS

- Be optimistic in highly estimating future sales.

- Be optimistic in keep your estimations low on future costs.

- Disregard or discount weaknesses in your plan and be bold enough to spell them out.

- Avoid stressing on long-term projections. It’s always better to focus on projections for your first year and do short term planning to achieve long term goals.

- Depend entirely on the uniqueness of your business or the success of an invention.

- Project yourself as someone you’re not. Be brutally realistic.

- Be everything to everybody. Highly focused specialists usually do best.

- Proceed without adequate financial and accounting know-how.

- Base your business plan on a wonderful concept. Test it first.

- Pursue a business not substantiated by your business plan analysis.

10+ Business Plan Templates Formats

- B-Plans:com is also known as the authority on business plans, that caters to offer a free Word business plan template along with a complete user manual with instructions and a table of contents.B-Plan’s Word business plan templates are comprehensive and are a great option for beginners and new business owners who have just stepped into this field.

- com: Entrepreneur.com provides a collection of various business tools which are essentially helpful when you set onto venture in this area. The templates can be viewed or be downloaded if you need it for future references through the Seamless Docs platform.

- Law Depot: The Law Depot is a step-by-step business plan builder that was introduced and offered by the Law Depot.It covers that basic ingredients that you require in your Business plans like the structure, product marketing, SWOT (strengths, weaknesses, opportunities, threats), operations, and details specific to your business in their templates.

- My Own Business Institute: MOBI, or My Own Business Institute, is part of Santa Clara University’s Center for Innovation and Entrepreneurship that offers a fifteen-section business plan template, including the business profile, licenses/permits, and location, which is available for free download in Word as individual templates, or as a larger all-in-one document.

- Office Depot: is a Business Resource Center contains free business plan samples for retailers, manufacturers and service providers. Excel business plan financials are also available for manufacturers and service providers, while the retailer business plan template is complete with forecasting and financial tables.

- Com: Catering to businesses owned by women, Oprah.com is a free one-page business plan templates that can be used by anyone who wants to start a business. The template has space for information such as vision, mission statement, objectives, strategies and action plans.

- Rocket Lawyer: The template used here is questionnaire-style and asks for key information about your business such as founders, structure and industry, marketing plans, financial projections, etc. Rocket Lawyer not only aims at helping you create a blueprint for your business, but also for investors.

- Small Business Administration: The Small Business Administration (SBA) offers an online business plan template and guide to help you build your business plan, step by step. It gives the facility to choose from six business plan sections(Executive Summary, Company Description, Market Research, Product/Service Line, Marketing and Sales, Financial Projections).

- The $100 Startup’s One-Page Business Plan: The $100 Startup, a New York Times and Wall Street Journal bestseller, offers the One-Page Business Plan. This free business plan template covers everything from your business overview to finances, marketing, goals, and challenges it also includes resources which include a one-page consulting business plan, one-page marketing plan, product launch guide and many more of this type.

- Free-Plan: The Free-Plan offers a comprehensive Word-based document that contains a detailed framework for building your business plan, including sample text, tables, and charts, as well as a manual with section-by-section assistance.

- com: Finance basically deals with investments and finance-related issues. V Finance is a publicly traded company that uses their own personal knowledge of investment in creating a business plan template. With this site, you can download a free business plan template targeted to your industry.

- com: This online business plan allows you to fill out a template on the site section by section. It also tracks down your progress on the plan and allows you to share the plan once it’s completed.

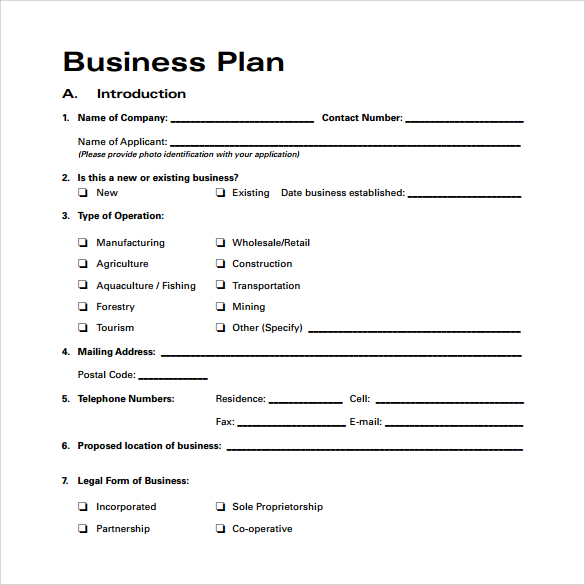

Important Ingredients of a Good Business Plan Letter

Business Plan Format: The Business Plan format is a systematic assessment of all the factors critical to your business purpose and goals keeping in mind the shortcomings.

- A Vision Statement: It tells about your goals in few words. This will be a concise outline of your business purpose and goals.

- The People: The most important ingredient for your success will be yourself. Focus on how your prior experiences will be applicable to your new business. Be factual and avoid hype. This part of your Business Plan will be read very carefully by those with whom you will be having relationships, including lenders, investors, and vendors.

- Your Business Profile: Define and describe your intended business and exactly how you plan to go about it. Try to stay focused on the specialized market you intend to serve. As a rule, specialists do better than non-specialists.

- Economic Assessment: Provide a complete assessment of the economic environment in which your business will become a part. Explain how your business will be appropriate for the regulatory agencies and demographics with which you will be dealing. If appropriate, provide demographic studies and traffic flow data normally available from local planning departments.

- Cash Flow Assessment: Include a one-year cash flow that will incorporate your capital requirements. Include your assessment of what could go wrong and how you would plan to handle problems.

- Marketing Plan and Expansion Plans: Your expansion plan should describe how you plan to test markets and products before rolling out. SCORE offers a great marketing plan guide.

- Damage Control Plan: All businesses will experience episodes of distress. Survival will depend on how well you are prepared to cope with them. Your damage control plan should anticipate potential threats to your business and how you plan to overcome them. Here are three examples:

- Plan for 35% loss of sales: During economic downturns, your survival will depend on your ability to maintain liquidity for a period of at least 12 months.

Can your Damage Control cash flow plan show how to avoid running out of cash?

- Plan for a catastrophic incident: Businesses can be overturned by unforeseen disasters which can be avoided by maintaining appropriate insurance. You will need the assistance of a qualified business insurance agent.

- Plan for product obsolescence: If your business is in a rapidly changing technology area such as Netflix’s home delivered DVDs, you will need to plan now to keep a step ahead of technical changes or advancements.